Offshore Trustee Solutions: Your Strategic Companion in Global Asset Monitoring

Wiki Article

Open the Conveniences: Offshore Trust Fund Solutions Discussed by an Offshore Trustee

Offshore count on services have actually ended up being increasingly prominent among businesses and individuals looking for to optimize their economic techniques. In this interesting guide, we explore the globe of offshore counts on, supplying a detailed understanding of their advantages and just how they can be properly utilized. Written by an offshore trustee with years of experience in the field, this source provides beneficial insights and professional recommendations. From the fundamentals of overseas trust funds to the details of tax obligation preparation and possession protection, this guide checks out the different advantages they offer, including enhanced personal privacy and confidentiality, flexibility and control in wide range management, and access to global investment chances. Whether you are a skilled investor or brand-new to the concept of overseas depends on, this guide will certainly equip you with the understanding essential to unlock the advantages of these effective monetary devices.The Fundamentals of Offshore Counts On

The basics of overseas trust funds include the establishment and management of a trust fund in a jurisdiction beyond one's home nation. Offshore depends on are often utilized for possession protection, estate preparation, and tax optimization objectives. By putting possessions in a depend on located in an international jurisdiction, individuals can guarantee their assets are protected from prospective dangers and liabilities in their home nation.Developing an offshore depend on usually requires engaging the services of a professional trustee or depend on firm that is fluent in the legislations and policies of the chosen territory. The trustee functions as the legal owner of the possessions kept in the trust fund while managing them based on the terms laid out in the trust fund act. offshore trustee. This setup offers an added layer of defense for the possessions, as they are held by an independent 3rd party

Offshore counts on supply several advantages. First of all, they can give enhanced personal privacy, as the information of the depend on and its recipients are commonly not publicly revealed. Secondly, they use potential tax obligation benefits, as specific territories may have much more positive tax obligation routines or use tax obligation exceptions on specific kinds of earnings or properties kept in count on. Finally, offshore trusts can help with reliable estate preparation, allowing people to hand down their wide range to future generations while minimizing inheritance tax obligation liabilities.

Tax Obligation Preparation and Asset Defense

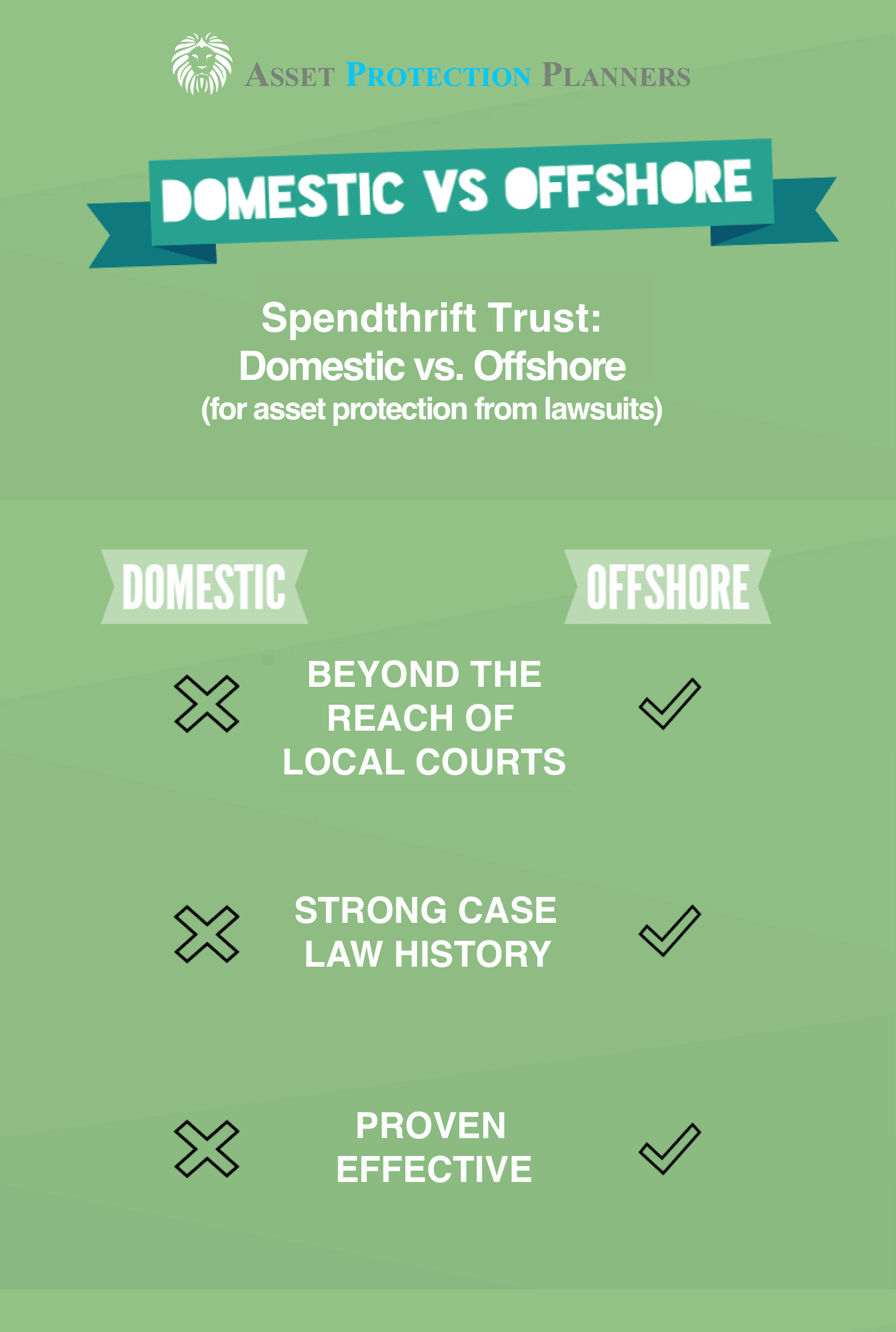

Tax planning and asset protection play a critical function in the tactical utilization of offshore trusts. Offshore depends on supply people and services with the chance to reduce their tax obligation liabilities legitimately while securing their possessions.Possession protection is one more key element of overseas trust fund services. Offshore counts on offer a robust layer of security against prospective dangers, such as suits, financial institutions, or political instability. By moving assets right into an overseas count on, people can protect their riches from prospective lawful cases and ensure its preservation for future generations. Furthermore, offshore counts on can use confidentiality and privacy, more securing possessions from spying eyes.

Nonetheless, it is essential to note that tax preparation and possession defense should constantly be carried out within the bounds of the regulation. Participating in illegal tax obligation evasion or illegal asset protection methods can lead to serious effects, including penalties, charges, and damages to one's reputation. Therefore, it is necessary to look for professional recommendations from experienced overseas trustees who can direct people and organizations in structuring their overseas counts on in a ethical and certified way.

Improved Personal Privacy and Confidentiality

Enhancing personal privacy and discretion is a vital purpose when utilizing overseas trust services. Offshore trusts are renowned for the high level of privacy and confidentiality they provide, making them an appealing option for organizations and people seeking to safeguard their assets and financial info. Among the key advantages of overseas trust services is that they offer a lawful framework that allows people to keep their economic events personal and protected from prying eyes.

The improved privacy and discretion offered by offshore counts on can be particularly advantageous for people who value their privacy, such as high-net-worth individuals, stars, and specialists seeking to shield their possessions from prospective claims, lenders, and even family members disputes. By utilizing offshore depend on services, people can preserve a greater degree of personal privacy and confidentiality, permitting them to guard their wide range and economic passions.

Nevertheless, it is important to note that while overseas trusts offer enhanced privacy and confidentiality, they have to still abide by suitable laws and guidelines, consisting of anti-money laundering and tax coverage needs - offshore trustee. It is important to collaborate with respectable and skilled offshore trustees and lawyers that can guarantee that all legal obligations are fulfilled while making the most of the personal privacy and confidentiality benefits of offshore trust solutions

Flexibility and Control in Wide Range Monitoring

Offshore trusts use a substantial degree of versatility and control in riches management, enabling companies and individuals to efficiently manage their assets while keeping personal privacy and confidentiality. Among the essential benefits of offshore counts on is the ability to tailor the count on framework view it now to satisfy particular demands and goals. Unlike conventional onshore trust funds, offshore depends on supply a large range of alternatives for property defense, tax preparation, and sequence planning.With an offshore trust fund, businesses and individuals can have better control over their wide range and how it is handled. They can select the territory where the depend on is established, permitting them to benefit from desirable regulations and policies. This versatility enables them to optimize their tax setting and shield their possessions from potential threats and responsibilities.

Additionally, offshore trust funds use the option to assign expert trustees who have considerable experience in taking care of complicated counts on and browsing worldwide policies. This not just ensures effective wide range management but additionally gives an additional layer of oversight and safety and security.

Along with the adaptability and control supplied by overseas trusts, they also supply confidentiality. By holding assets in an overseas jurisdiction, companies and people can safeguard their financial details from prying eyes. This can be specifically valuable for high-net-worth people and businesses that value their privacy.

International Financial Investment Opportunities

International diversity supplies people and businesses with a plethora of investment opportunities to broaden their portfolios and mitigate risks. Buying worldwide markets enables financiers to access a wider variety of property courses, markets, and geographical areas that might not be readily available locally. By expanding their financial investments throughout various nations, capitalists can minimize their direct exposure to any type of single market or economic climate, therefore spreading their threats.One of the key advantages of worldwide investment opportunities is the capacity for greater returns. Various countries may experience varying economic cycles, and by spending in numerous markets, investors can take advantage of these cycles and possibly accomplish higher returns compared to investing exclusively in their home nation. In addition, investing internationally can additionally recommended you read give access to arising markets that have the possibility for quick economic development and higher financial investment returns.

Moreover, international financial investment chances can provide a hedge against money threat. When investing in international currencies, capitalists have the possible to take advantage of currency fluctuations. For example, if a financier's home money weakens versus the money of the international financial investment, the returns on useful reference the investment can be amplified when converted back to the capitalist's home money.

Nevertheless, it is essential to note that investing internationally additionally comes with its own collection of risks. Political instability, regulatory changes, and geopolitical uncertainties can all affect the efficiency of global investments. It is crucial for capitalists to conduct comprehensive research and seek professional guidance before venturing right into international investment chances.

Verdict

The fundamentals of offshore depends on include the facility and management of a depend on in a jurisdiction outside of one's home nation.Establishing an offshore count on commonly calls for engaging the services of a professional trustee or depend on firm who is fluent in the legislations and policies of the picked territory (offshore trustee). The trustee acts as the lawful proprietor of the possessions held in the trust fund while handling them in accordance with the terms set out in the trust fund action. One of the essential advantages of overseas counts on is the capability to customize the count on framework to fulfill details requirements and objectives. Unlike typical onshore trusts, offshore trust funds offer a wide variety of options for property security, tax obligation planning, and sequence planning

Report this wiki page